Politics

Jai Bapu Jai Bhim Jai Samvidhan Campaign Social Justice

The Indian National Congress launches the Jai Bapu, Jai Bhim, Jai Samvidhan campaign to promote social justice, unity, and equality in India.

The Indian National Congress (INC) will launch a new campaign titled ‘Jai Bapu, Jai Bhim, Jai Samvidhan’, an initiative that honors three of India’s most iconic figures: Mahatma Gandhi, Dr. B.R. Ambedkar, and the Indian Constitution. This campaign, rooted in the principles of social justice, equality, and secularism, seeks to reflect the Congress party’s commitment to the democratic and inclusive ideals that these personalities represent.

“The Legacy of Mahatma Gandhi”

Mahatma Gandhi, known as the Father of the Nation, played a pivotal role in India’s struggle for independence. His philosophy of non-violence (ahimsa) and truth (satyagraha) continues to inspire leaders and movements worldwide. Gandhi’s unwavering belief in equality and justice laid the foundation for India’s democratic framework. By invoking Gandhi’s legacy in the ‘Jai Bapu’ part of the campaign, the Congress party seeks to remind the public of his vision for a free, fair, and just society, one where communal harmony and tolerance prevail.

In the contemporary context, Gandhi’s message resonates deeply amid the rising political and social divisions in India.

The Congress party aims to reinstate the relevance of Gandhi’s ideals in a time when the country is grappling with issues of intolerance, inequality, and violence. The ‘Jai Bapu’ campaign serves as a timely reminder of the need to embrace Gandhi’s teachings of peace, unity, and secularism in these turbulent times.

“Honoring Dr. B.R. Ambedkar’s Vision of Equality”

Dr. B.R. Ambedkar, the principal architect of the Indian Constitution, was a fierce advocate for the rights of the marginalized, particularly Dalits and backward classes.

Known as the champion of social justice, Ambedkar’s work laid the foundation for a society where the principles of liberty, equality, and fraternity are enshrined in law. His relentless fight for the upliftment of the oppressed and downtrodden continues to inspire movements advocating for social and economic justice.

Incorporating ‘Jai Bhim’ in the campaign highlights the Congress party’s commitment to addressing the social inequities that still plague Indian society. It underscores the party’s resolve to combat caste-based discrimination and ensure that Dr. Ambedkar’s vision for an inclusive India becomes a reality. The ‘Jai Bhim’ slogan is not just symbolic; it is a call for action to uplift marginalized communities and provide them with opportunities for empowerment and progress.

“Reaffirming the Constitution’s Secular Values”

The final leg of the campaign, ‘Jai Samvidhan’, pays tribute to the Indian Constitution, which stands as a beacon of secularism, democracy, and human rights. The Constitution, drafted under the leadership of Dr. Ambedkar, guarantees fundamental rights to all citizens, irrespective of caste, creed, or religion. It envisions a pluralistic society where the dignity of the individual is protected, and justice is accessible to all.

As India faces growing challenges related to communalism, religious intolerance, and threats to democratic institutions, the Congress party aims to use this campaign to reaffirm its commitment to the secular values enshrined in the Constitution. The ‘Jai Samvidhan’ slogan serves as a reminder that the Constitution is not just a legal document, but a living testament to India’s commitment to justice, equality, and fraternity.

“The Way Forward for the Campaign”

The ‘Jai Bapu, Jai Bhim, Jai Samvidhan’ campaign is set to be a defining moment for the Indian National Congress, positioning the party as the torchbearer of social justice, equality, and secularism.

The Congress seeks to reach out to citizens across the nation, reminding them of the importance of upholding these values in today’s political landscape.

By launching this campaign, the Congress party hopes to invigorate its base while also appealing to the broader public who cherish the legacies of Gandhi, Ambedkar, and the Constitution. In an era where the very ideals of equality and justice are being questioned, this campaign aims to ignite a sense of unity and collective purpose among the people of India, urging them to stand together for a better, more inclusive future.

Watch and Subscribe to the YouTube Channel: EBT Entrepreneur Business Times

Useful Topics:

Entrepreneur Business Times | EBT – Entrepreneur Business Times | Entrepreneurship Latest News & Headlines | Business News | Startup News | CEO Interviews | Automotive News | Pharmaceutical News | FMCG News | Electric Vehicle News | Electrical and Electronics News | Sanitary and Hardware News | Technology News | Politics News | Fashion News | Sports News | Education News | Entertainment News | Video| Entrepreneur Media India | Business News Live | Share Market News | Business Times | Entrepreneurship News India | Entrepreneurship News today | Awards for entrepreneurs in India | Young Entrepreneur Awards India | Latest entrepreneurs in India | Starting a Business | Entrepreneurship in India | Entrepreneur Magazine | Business News Live | Entrepreneur Motivation | Entrepreneur Mindset | Entrepreneur podcast | Entrepreneur | How to become an Entrepreneur | How to be an entrepreneur

Business

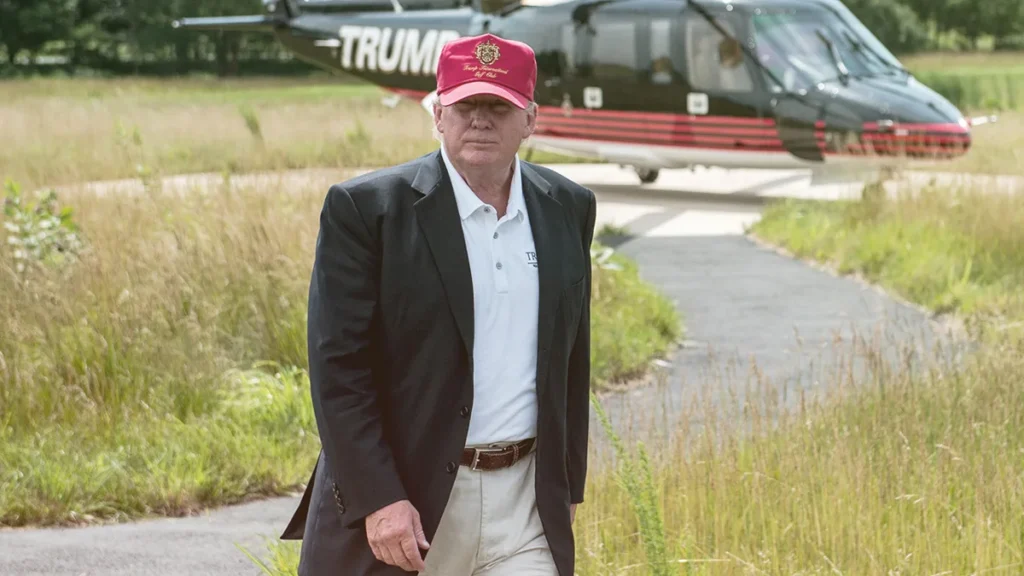

Donald Trump Announces Fresh Tariffs – Which Countries Will Suffer Most?

President Donald Trump Announces Fresh Tariffs

In a move that has sent ripples through global markets, President Donald Trump has announced a new wave of tariffs set to take effect on August 1, 2025. The most severely impacted nations face steep rates of up to 40%, with Myanmar and Laos bearing the brunt of these economic measures. This escalation marks a significant turning point in America’s trade policy, as the administration adopts an increasingly aggressive stance toward what it perceives as unfair trading practices.

While the deadline looms large on the economic horizon, Trump has indicated it’s “not 100 percent firm,” suggesting room for diplomatic maneuvering. So far, only the United Kingdom and Vietnam have successfully negotiated trade agreements with the U.S., leaving 12 other trading partners scrambling to secure deals before the tariffs kick in. The President has also issued a stark warning: any retaliatory measures from affected nations will trigger equivalent responses from the United States, potentially spiraling into an even more intense trade conflict. As global markets brace for impact, let’s examine which countries stand to lose the most, how these tariffs will be structured, and what economic implications we can expect in the coming months.

Trump’s New Tariff Announcement

On July 7, 2025, President Donald Trump signed an Executive Order extending certain tariff rates until August 1, 2025. This decision follows his April 2025 declaration of a national emergency in response to trade practices threatening U.S. economic and national security. The administration has positioned these measures as necessary steps to address the persistent U.S. goods trade deficit and establish more balanced bilateral trade relationships.

Implementation date set for August 1

The new reciprocal tariff rates will take effect on August 1, 2025, replacing the previous rates that were set to expire on July 9. This timeline provides affected countries with a short adjustment period while maintaining pressure for trade concessions. The implementation follows approximately 90 days after the modification of previous tariff rates, during which time numerous countries have engaged in negotiations with the U.S. administration.

Tariff rates reaching up to 40% for some countries

The announced tariff structure varies significantly by country, with some nations facing substantial increases. Countries that have received notification of their new rates include Japan and South Korea (both at 25%), South Africa (30%), and others facing even higher rates approaching 40%. These rates represent a dramatic increase from historical tariff levels, with the average U.S. tariff rate jumping from 2.5% to an estimated 27% since Trump’s return to office—the highest level in over a century.

Flexibility in the negotiation timeline

While implementing these substantial tariffs, the Trump administration has signaled its willingness to adjust rates based on trade negotiations. Countries that have agreed to lower their tariffs or eliminate non-tariff barriers have seen more favorable treatment, with some experiencing lower rates than previously announced. The administration emphasizes that countries willing to manufacture on U.S. soil will face no tariffs, creating a significant incentive for foreign businesses to invest in American manufacturing facilities.

With these new tariff announcements established, let’s examine which countries will bear the heaviest economic impact from Trump’s trade policy in our next section, “Countries Most Affected by New Tariffs.”

Countries Most Affected by New Tariffs

A. Myanmar and Laos face the highest rates at 40%

Now that we’ve examined Trump’s tariff announcement, let’s examine which countries are most affected. Myanmar and Laos face the steepest tariffs at 40%, impacting Myanmar’s clothing exports and Laos’ electronic goods. Myanmar’s military government, represented by Maj. Gen. Zaw Min Tun has expressed willingness to negotiate, while both nations struggle with the highest penalty rates among all targeted countries.

B. Impact on 14 trading partners

The tariffs affect a total of 14 trading partners with varying rates. After Myanmar and Laos at 40%, Cambodia and Thailand face 36% tariffs (Cambodia’s rate was reduced from an initially proposed 49%). Bangladesh follows with a 35% tariff primarily affecting its crucial garment industry. South Africa faces a 30% rate, while Japan, Malaysia, South Korea, and Tunisia all received 25% tariffs targeting their key export sectors, including automobiles and electronics.

C. Exceptions for countries with finalized agreements (UK and Vietnam)

Some nations have successfully negotiated exemptions from these punitive measures. The United Kingdom and Vietnam have finalized trade agreements with the United States, earning them complete exceptions from the new tariff regime. These successful negotiations demonstrate the potential path forward for affected countries, as President Trump’s administration has indicated a willingness to remove tariffs for nations that secure satisfactory trade deals. With these country-specific impacts established, we’ll next examine the tariff structure and implementation timeline in greater detail.

Photo Source: https://www.trump.com/leadership/donald-j-trump-biography

Politics

Ruby Phogat Yadav BJP Delegation Congratulates CM Rekha Gupta

Ruby Phogat Yadav led a BJP delegation to CM Rekha Gupta’s residence, emphasizing party unity and development goals.

Hundreds of BJP party workers accompanied the leader to the Chief Minister’s home, where they extended their congratulations. Ruby Phogat Yadav, known for her dedication and commitment, has been an influential figure in the party.

Her presence at Chief Minister Rekha Gupta’s residence highlights the sense of unity and camaraderie within the BJP ranks. Phogat’s visit to the Chief Minister is not just a formality but a symbol of the collective support within the party. During her time there, the leader engaged with party activists and discussed plans for spreading the party’s message. The honoring of Chief Minister Rekha Gupta is a testament to the leadership style that Ruby Phogat Yadav embodies. The Chief Minister, in turn, expressed gratitude for the overwhelming support from party workers and stated the importance of continued collaboration within the party.

Phogat’s visit is being seen as an opportunity to consolidate efforts toward building a strong party base in the region. The Chief Minister’s residence was enthusiastic as party workers celebrated their leader’s visit and united in their resolve to work toward the party’s success. “Phogat’s presence at Chief Minister Rekha Gupta’s residence sent a strong message of unity and support within the party, underscoring the importance of working together towards common goals. The grounds of the Chief Minister’s home echoed with words of encouragement and optimism as party workers gathered around their leader to discuss strategies for the upcoming challenges.

Ruby Phogat Yadav’s proactive approach, combined with support from party members, aims to strengthen the party’s structure and outreach. As party synergies bloom in the state, the visit plays a vital role in laying the groundwork for long-term achievements. With Ruby Phogat Yadav’s experience and Chief Minister Rekha Gupta’s leadership, the BJP is positioned to make significant strides in the region. The joint efforts will be instrumental in bringing a positive change for the people and have the potential to leave a lasting impact on the BJP’s presence in the area.” Party members are optimistic that Phogat’s visit can pave the way for further collaborations.

Chief Minister’s Rekha Gupta’s newly appointed office was gifted a batch of BJP tradition as hundreds of party workers, greeted her at Delhi chief minister’s house them. Ruby Phogat Yadav delightedly reached out for their support.

During the meeting, Ruby Yadav wished Rekha Gupta and discussed the development of Delhi. Infrastructure, education, healthcare, and other prime areas of focus for the growth of the city were some topics discussed during the conversation.

“We are always up for contributing positively to the development of Delhi,” Ruby Yadav said. We hope the city will soar to new heights under Chief Minister Rekha Gupta Ji’s leadership.”

The enthusiasm and energy witnessed among BJP workers during the visit and the common intention for a better Delhi, as articulated by the two leaders, show great prospects of the both working together,” a joint statement read.

Useful Topics:

Entrepreneur Business Times | EBT – Entrepreneur Business Times | Entrepreneurship Latest News & Headlines | Business News | Startup News | CEO Interviews | Automotive News | Pharmaceutical News | FMCG News | Electric Vehicle News | Electrical and Electronics News | Sanitary and Hardware News | Technology News | Politics News | Fashion News | Sports News | Education News | Entertainment News | Video| Entrepreneur Media India | Business News Live | Share Market News | Business Times | Entrepreneurship News India | Entrepreneurship News today | Awards for entrepreneurs in India | Young Entrepreneur Awards India | Latest entrepreneurs in India | Starting a Business | Entrepreneurship in India | Entrepreneur Magazine | Business News Live | Entrepreneur Motivation | Entrepreneur Mindset | Entrepreneur podcast | Entrepreneur | How to become an Entrepreneur | How to be an entrepreneur

Politics

Union Budget 2025 Tax Reforms Middle Class

The Union Budget 2025 introduces significant tax relief for salaried individuals, focusing on raising the tax exemption limit and revising tax slabs, benefiting the middle class.

The Union Budget 2025, presented by Finance Minister Nirmala Sitharaman, has unveiled a series of key tax reforms aimed at providing significant relief to salaried individuals, particularly the middle class. In a move to stimulate economic growth and increase disposable income, the government has proposed several measures that will directly benefit taxpayers across various income brackets. These reforms are seen as part of the broader strategy to boost consumption, savings, and investments, thereby fostering overall economic development.

“Increased Tax Exemption Threshold”

One of the most notable announcements in the Union Budget 2025 is the increase in the income tax exemption threshold.

Under the new provisions, individuals earning up to Rs 12 lakh annually will be completely exempt from paying income tax. This marks a significant rise from the previous exemption limit of Rs 7 lakh. This move is expected to benefit millions of salaried employees who will now retain a larger portion of their income, ultimately increasing their purchasing power.

With the increase in the exemption limit, taxpayers will have more flexibility in managing their finances and allocating funds toward savings, investments, and discretionary spending. The government’s decision to raise the tax exemption threshold reflects its focus on supporting the salaried middle class, which forms the backbone of India’s consumer-driven economy.

“Revised Tax Slabs to Provide Relief”

Along with the increased exemption limit, the government has also introduced revised tax slabs for the 2025-26 financial year.

The new structure includes several changes designed to reduce the tax burden on middle-income earners. The tax slabs are now as follows:

- Income up to Rs3 lakh: Nil

- Rs 3 lakh to 7 lakh: 5%

- Rs 7 lakh to 10 lakh: 10%

- Rs 10 lakh to 12 lakh: 15%

- Rs 12 lakh to 15 lakh: 20%

- Above Rs15 lakh: 30%

These changes are expected to significantly benefit taxpayers within the Rs 3 lakh to Rs 10 lakh range, who will see a reduced tax liability. For those earning above Rs10 lakh, the tax burden will remain, but the adjustment in the lower slabs is a move in the right direction, offering more financial flexibility for salaried individuals.

“Higher Standard Deduction for Salaried Employees”

The Union Budget 2025 also includes a generous increase in the standard deduction for salaried employees.

The deduction has been raised from Rs 50,000 to Rs 75,000 annually, providing an additional tax-saving opportunity. This increase is expected to reduce the taxable income of salaried employees and give them more take-home pay at the end of the month.

In addition to the standard deduction, the government has also increased the deduction available for family pensions. The deduction for family pensioners has been raised from Rs 15,000 to Rs 25,000, ensuring that senior citizens, who depend on pensions for their livelihood, receive much-needed relief.

“The middle class Benefits the Most”

The primary beneficiaries of these tax reforms are the salaried middle class, which has been facing the brunt of rising costs and inflation.

With more money in their hands due to reduced taxes, individuals will be able to increase their spending power, stimulating demand in various sectors of the economy.

Additionally, the revised tax structure aims to incentivize savings and investment, allowing individuals to invest more in instruments like mutual funds, pension schemes, and insurance policies. This shift towards greater financial independence and security is expected to have long-term positive effects on both personal finances and the country’s overall economic stability.

“A Boost to Economic Growth”

These reforms are not only designed to provide immediate relief to taxpayers but also to bolster long-term economic growth.

By enhancing disposable income and encouraging increased consumption, the government aims to stimulate demand and investment, which will, in turn, create jobs and contribute to India’s economic recovery and growth trajectory.

In conclusion, the Union Budget 2025 has delivered much-needed tax relief for the salaried middle class, with measures aimed at reducing the tax burden, increasing disposable income, and encouraging savings. These reforms mark a significant shift in India’s tax landscape and are expected to have a positive impact on the economy, driving growth and improving the financial well-being of millions of taxpayers. As the country navigates its path toward economic recovery, these tax measures will play a crucial role in shaping the future of India’s middle class.

Useful Topics:

Entrepreneur Business Times | EBT – Entrepreneur Business Times | Entrepreneurship Latest News & Headlines | Business News | Startup News | CEO Interviews | Automotive News | Pharmaceutical News | FMCG News | Electric Vehicle News | Electrical and Electronics News | Sanitary and Hardware News | Technology News | Politics News | Fashion News | Sports News | Education News | Entertainment News | Video| Entrepreneur Media India | Business News Live | Share Market News | Business Times | Entrepreneurship News India | Entrepreneurship News today | Awards for entrepreneurs in India | Young Entrepreneur Awards India | Latest entrepreneurs in India | Starting a Business | Entrepreneurship in India | Entrepreneur Magazine | Business News Live | Entrepreneur Motivation | Entrepreneur Mindset | Entrepreneur podcast | Entrepreneur | How to become an Entrepreneur | How to be an entrepreneur